INFICON: Good Order Intake and Resilient Performance in Demanding Markets

«Ad hoc announcement pursuant to Art. 53 LR»

Bad Ragaz/Switzerland, October 23, 2025

- Book-to-bill ratio above 1 for the third consecutive quarter. Orders increase substantially year-on-year in all end markets and most regions

- Sales remain stable for the first nine months (-0.8%); resilient third quarter sales of USD 163.9 million (year-on-year -4.9%) despite weaker sales to the Semiconductor market in China and the Security & Energy market in the USA

- Production reconfiguration concluded. INFICON is well positioned for future geopolitical uncertainties.

- Operating income margin at 14%; lingering impacts of trade disputes - temporary capacity duplication, negative foreign exchange effects, and unavoidable tariffs. Efficiency measures in execution

- INFICON narrows guidance for the full year 2025: Sales of USD 660-680 (previously 660-690) million; operating income margin of 16% - 17% (previously: around 18%)

In the third quarter of 2025 INFICON concluded the reconfiguration of the production. INFICON has quickly adjusted its global production setup to seamlessly serve its customers best and to avoid heavy tariffs. The Book-to-bill ratio is above 1 for the third consecutive quarter. Orders increase substantially year-on-year in all end markets and most regions.

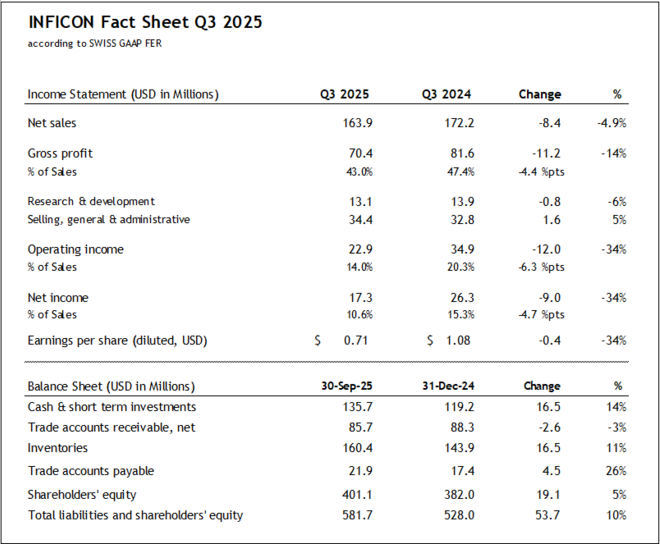

INFICON achieved solid third quarter sales of USD 163.9 million (-4.9%, organically: -7.0%) after second highest sales figure of USD 172.2 million recorded a year ago. Sales generated during the first nine months of 2025 remained flat at USD 489.6 million (-0.8%).

INFICON generated a strong 9.3% sales increase to USD 35.9 million in its Refrigeration, Air Conditioning & Automotive market (21.9% of sales). The positive sales trend was especially supported by the accelerated demand for INFICON’s service tools in North America and Asia. The automotive and battery-related businesses developed steadily with some upswing in China. Sales to the General Vacuum market (27.5% of sales) surged by 19.6% to USD 45.0 million in the yearly comparison or by 6.3% against the preceding quarter with particularly strong performance in Asia Pacific and in China. While the Semiconductor & Vacuum Coating market developed steadily in Europe, North America and Asia, the business with Chinese chip makers slowed down. The broad semiconductor upswing delays into 2026/27. INFICON reports for this target market year-on-year 14.1% and quarter-on-quarter 5.6% lower sales of USD 77.5 million, while year-to-date sales remained almost stable (-1.2%), representing 47.3% of sales after 52.4% a year ago. As expected, sales to the Security & Energy market fell by 52.2% in the yearly, and by 20.3% in the quarterly comparison to USD 5.5 million. This market is characterized by cyclical public sector orders. Following a temporary decline, new major orders were received in September 2025, which underscore the long-term attractivity of this market especially as defense budgets increase.

The regional sales performance mirrors the solid business development in INFICON’s target markets, highlighting its strong global footprint and intimate customer partnership: Sales to Europe grew year-on-year by 3.9% and quarter-on-quarter by 5.8% to USD 39.2 million (23.9% of sales). Sales to Asia-Pacific excluding China increased by 23.4% year-on-year or by 3.6% quarter-on-quarter to USD 43.7 million (26.7% of sales). This trend reflects the swift adjustments made to INFICON’s international structure including e.g. the ramp up of the subsidiary in Malaysia among various product relocation measures. In contrast, sales generated in China fell by 22.4% (year-on-year) or by 11.1% (quarter-on-quarter) to USD 42.6 million (26.0% of sales). This is primarily due to lower sales into the Semiconductor & Vacuum Coating market while sales to all remaining target markets in China grew. Sales generated in North America fell by 13.3%, mainly because of the temporary lower sales of Security & Safety products.

Solid balance sheet, pressure on margins

INFICON reported a gross profit margin of 43.0%, down from 47.4% last year. Most of the margin impacts are temporary and relate to trade disputes, tariffs, and certain strategic capacity duplication. Strong headwinds persist from foreign exchange rates. Operating costs increased only moderately by 1.7%. Adjusted for adverse currency effects, this represents a structural improvement and shows the positive effects of the ongoing measures taken to strengthen the efficiency of operations in response to the challenging environment. INFICON achieved an operating income of USD 22.9 million and a margin of 14.0%. This compares with the USD 34.9 million in operating income recorded a year ago and a margin of then 20.3%. Net income for the period was USD 17.3 million after USD 26.3 million generated in the third quarter last year. The net income margin fell from 15.3% at the end of September last year to 10.6%. Earnings per share were USD 0.71 after USD 1.08 a year ago.

INFICON generated a solid operating cash flow of USD 26.7 million after USD 18.7 million in the preceding quarter and USD 45.9 million a year ago. Inventory turns improved to 2.4 times. The strong focus on receivables collection reduced the days sales outstanding to 48.3, down from 48.7 days a year ago. The working capital amounted to USD 224.1 million compared with USD 221.4 million at the end of September 2024. During the third quarter, INFICON increased its inventories by USD 2.9 million to USD 160.4 million. INFICON closed the period with a net cash position of USD 60.5 million. The equity ratio remained strong at 69.0% after 72.3% a year ago.

Guidance

INFICON is positive on the order situation and market outlook. Certain risks and uncertainties connected to the ongoing trade disputes and unfavorable effects from foreign exchange rates remain. Against this backdrop, INFICON is narrowing its full-year guidance to sales of USD 660-680 million and an operating income margin of around 16%-17%.

Web conference

INFICON discusses its third quarter 2025 results in more detail today at 09:30 a.m. CEST in an English-language web conference. You can access the web conference via the following links: https://www.inficon.com/web-conference. The presentation is available from 07:00 a.m. in the investors’ area of the INFICON website www.inficon.com.

Communication Calendar

The communication calendar of INFICON is continuously updated and available online in the Investors’ section of the INFICON website www.inficon.com or directly at https://ir.inficon.com/financial-calendar/

E-Mail Alerts

To automatically receive notification via e-mail of the latest financial information from INFICON, sign-up for e-mail Alerts in the Investors’ section of the INFICON website at https://ir.inficon.com/contact-and-information-request/

About INFICON

INFICON is a leading provider of innovative instrumentation, critical sensor technologies, and Smart Manufacturing /Industry 4.0 software solutions that enhance productivity and quality of tools, processes and complete factories. These analysis, measurement, and control products are essential for gas leak detection in air conditioning/refrigeration, and automotive manufacturing. They are vital to equipment manufacturers and end-users in the complex fabrication of semiconductors and thin film coatings for optics, flat panel displays, solar cells and industrial vacuum coating applications. Other users of vacuum-based processes include the life sciences, research, aerospace, packaging, heat treatment, laser cutting and many other industrial processes. We also leverage our expertise in vacuum technology to provide unique, toxic chemical analysis products for emergency response, security, and environmental monitoring. INFICON is headquartered in Switzerland and has world-class manufacturing facilities in Europe, the United States and China, as well as subsidiaries in China, Denmark, Finland, France, Germany, Italy, Japan, Korea, Liechtenstein, Malaysia, Mexico, Singapore, Sweden, Switzerland, Taiwan, the United Kingdom and the United States. INFICON registered shares (IFCN) are listed on SIX Swiss Exchange. For more information about INFICON and its products, please visit www.inficon.com.

This press release and oral statements or other written statements made, or to be made by us contain forward-looking statements that do not relate solely to historical or current facts. These forward-looking statements are based on the current plans and expectations of our management and are subject to a number of uncertainties and risks that could significantly affect our current plans and expectations, as well as future results of operations and financial condition. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.